The global insurance industry sits at the center of the world’s economy, safeguarding trillions in assets and providing peace of mind for millions of people every day.

When disaster strikes, insurers are the safety net that helps families, businesses, and communities recover. But size comes with pressure. Carriers face rising catastrophe losses, climate volatility, shifting regulations, and customers who now expect the kind of instant service they get from online retailers and ride-share apps.

On the frontlines, claims teams are under strain. Volumes are climbing, loss events are more complex, and experienced adjusters are stretched thin.

Policyholders want answers in hours, not weeks. And they want to see exactly what’s happening with their claim every step of the way.

Too often, though, the process still looks stuck in the past: delayed site visits, static photos that only tell part of the story, and endless back-and-forth that leaves customers frustrated and claims teams inefficient.

But the best insurers are already adapting. They’re leaning on technology, especially visual tools and AI-powered support, to move faster, cut costs, and rebuild trust. With live video, automation, and better data, they’re proving that speed and accuracy don’t have to come at the expense of customer care.

Where the Current Claims Process Breaks Down

Picture this: your car gets hammered by hail.

You file a claim expecting quick help, but instead you’re told to wait a week for an adjuster. When they finally arrive, the inspection misses key details—meaning another follow-up visit, more waiting, and more stress.

Or imagine water pouring through your ceiling after a burst pipe.

The insurer needs to act fast to prevent further loss, but by the time a site visit is arranged, the damage has worsened, costs have climbed, and frustration has grown.

When Remote Visual Support Steps In

Now imagine an alternative.

Case Example 1 – Auto Claims

One major European insurer rolled out live video inspections for weather-related vehicle damage and the results were eye-opening. Instead of scheduling on-site assessments, customers received a secure link on their phone within hours of first contact. Guided by a claims specialist, they showed the damage in real time.

The payoff: cycle times dropped from an average of five days to less than 24 hours, and customer satisfaction scores jumped more than 20%.

Case Example 2 – Property Claims

A large home insurer used remote visual support to assess water damage in both urban and rural areas. In one case, a customer with a storm-damaged roof was connected to an adjuster within 90 minutes of reporting the loss. The adjuster confirmed the damage, authorized temporary repairs, and kicked off the settlement, all in a single call.

The outcome: no further damage, no extra visits, and a happier customer.

Why This Matters for Insurers

Every insurer has to balance rising customer expectations, regulatory demands, and the realities of large, distributed claims teams. Remote visual support provides a scalable, standardized way to deliver speed, transparency, and accuracy without adding headcount or travel costs.

It helps insurers:

- Reduce Claim Cycle Times – Live visual evidence cuts out days of waiting.

- Lower Operational Costs – Fewer site visits mean less travel and faster resolutions.

- Boost Customer Trust – Policyholders see their claim being reviewed in real time, with no mystery about what comes next.

- Improve Sustainability Metrics – Less travel means fewer emissions, supporting ESG goals.

Visual Claims Support at Scale

Visual claims aren’t just a pilot project anymore. They’re quickly becoming the new normal.

Deloitte reports that during the pandemic, some carriers saw virtual claims leap from single-digit adoption to as high as 55%. Customer-submitted photos and videos rose from 61% in early 2020 to 68% within months. What started as a crisis response is now a baseline expectation.

Insurers are also leaning on automation. Today, AI handles nearly one-third of claims across the industry, cutting average processing times from more than a week to just 36 hours.

When paired with live visual support, automation helps insurers deliver both speed and the human reassurance policyholders value in high-stress moments.

The Business Case in Numbers

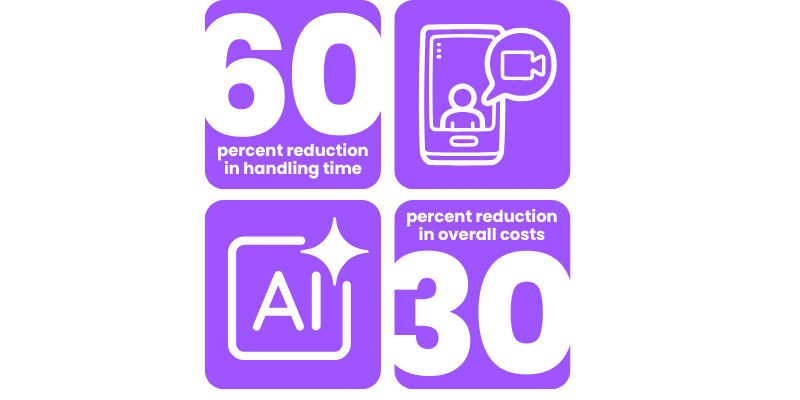

Visual claims tools aren’t just convenient, they deliver measurable ROI. Remote and AI-assisted claims can reduce handling times by up to 60% and cut costs by around 30%. Policyholders are on board, too: nearly three-quarters now say they prefer digital channels and remote claims management when given the option.

The supporting ecosystem is also booming. The global insurance analytics market—fueling dashboards and predictive models behind claims—is projected to grow from $13 billion today to nearly $50 billion by 2033. Insurers are already using these tools to visualize risk, spot fraud, and anticipate losses faster than ever before.

For claims leaders, the numbers are clear: the tools are mature, adoption is accelerating, and customers already expect them. The question isn’t whether to embrace visual claims support, it’s how quickly you can bring it to scale.

From Vision to Reality

This isn’t a theory. It’s already happening. Some of the world’s largest insurers are using visual technology to eliminate long-standing bottlenecks in the claims process.

SightCall VISION delivers these capabilities in a secure, insurance-ready platform. It integrates with existing claims management systems, supports high-quality live video on any device, and ensures compliance with privacy and security standards in the U.S., the U.K., and across Europe.

Whether it’s a motor claim, property loss, or complex damage assessment, VISION helps adjusters work faster, smarter, and more transparently.

The technology is proven. The results are measurable.