Trusted by Global Insurance Leaders

60%

AI driven claims automation

is expected to improve

claims handling times by 60%

while cutting costs by 30%

74%

of policyholders show a preference for digital communication channels

and remote claims management services

2.1M

Metric Tons of CO2 Emissions Avoided

25%

Increase in CSAT

69%

Decrease in Claims Handling Time

Global Insurance Innovators

Decreased claims time

Saved millions of kilometers of travel

Reduced FNOL times

Increased NPS rating

Boosted employee efficiency

Streamlined conflict resolution

Transformed sustainability efforts with visual claims support

SightCall for Insurance in Action!

How It Works

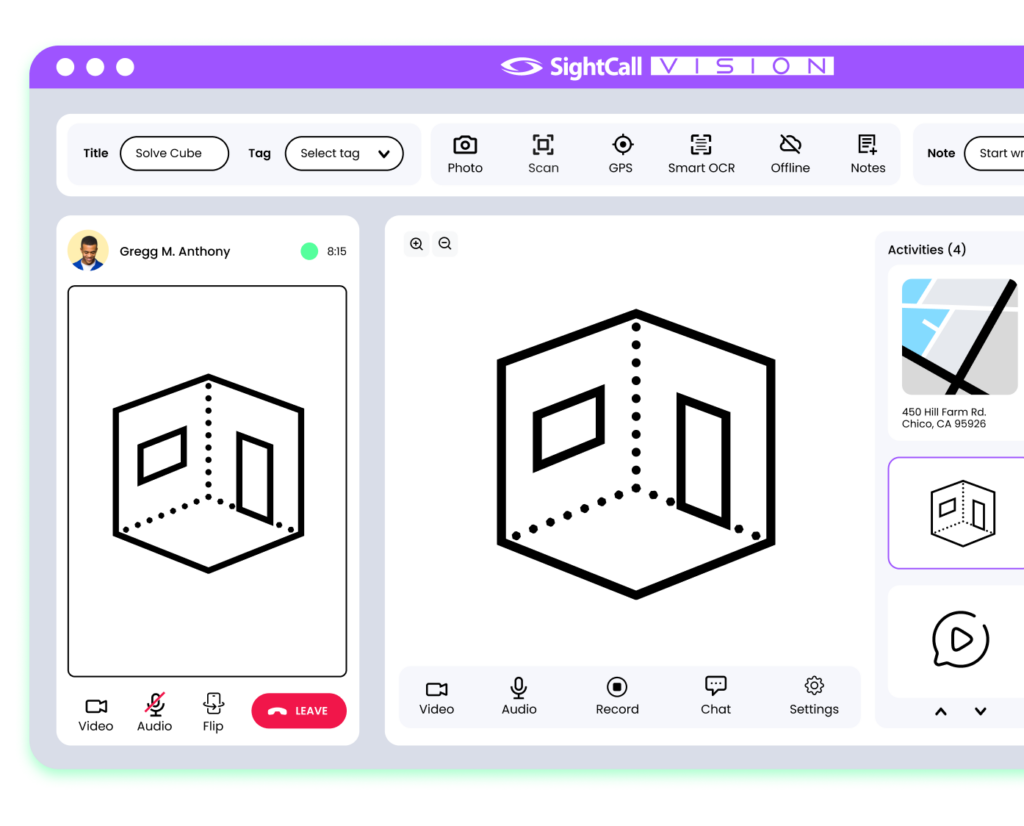

Seamless and Secure Video Calls

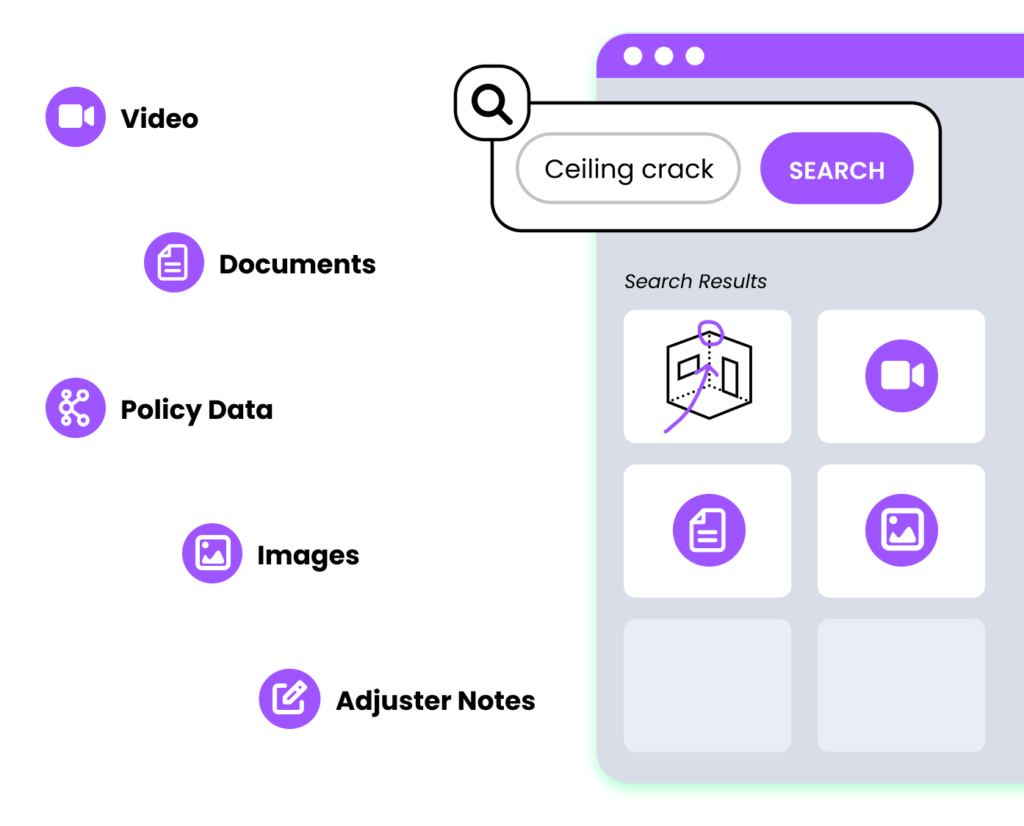

AI Powered Evidence Collection

During a live video session, AI analyzes the scene, documents, or objects to capture critical information, detect anomalies, and ensure accuracy

Improved Claim Accuracy

Enabling faster decision-making, increasing transparency, and improves customer confidence in the claims process.

High Definition

Connect instantly with patients through a secure, HD video stream.

Interactive Tools

Guided Self-Service Capture

Through intuitive prompts, visual cues, or AI-powered assistance, users can capture images, videos, or data.

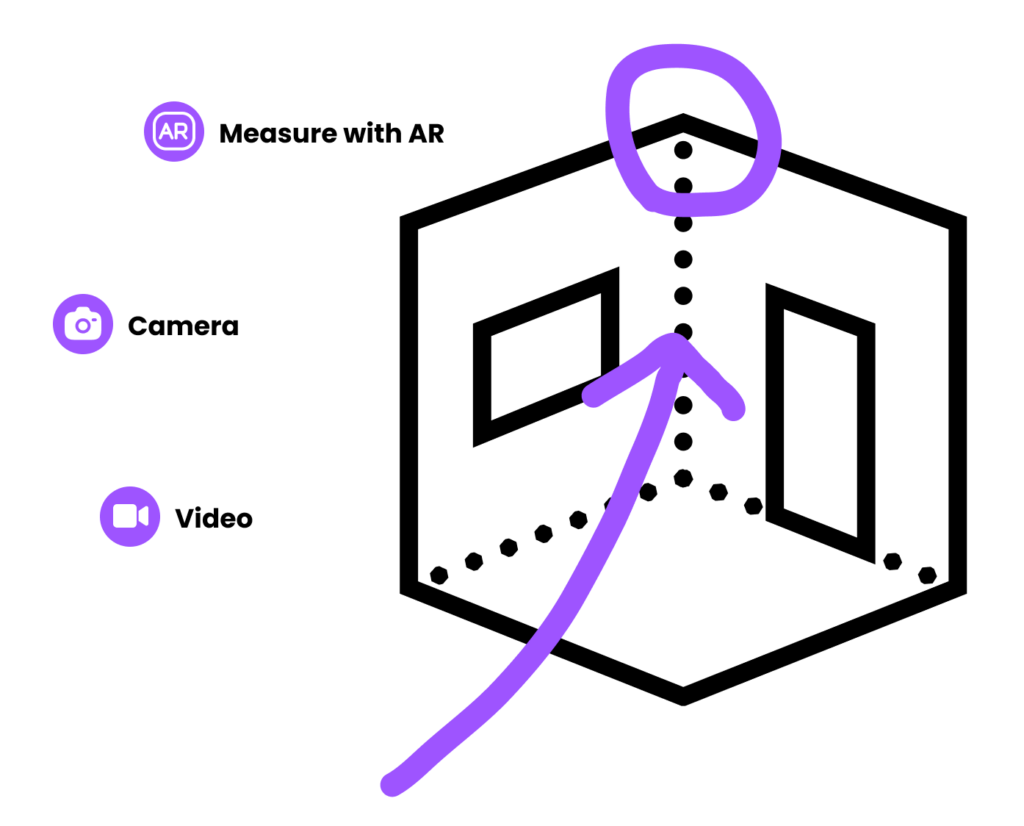

Interactive Augmented Reality

By overlaying digital instructions or measurements onto the actual scene, AR guides users through accurate data capture, inspections, or repair assessments. This immersive approach reduces errors, speeds up claim processing, and ensures a clear, verifiable record for both insurers and customers.

Fast, Efficient and Error Free

Capture Visual Sessions

Allowing your company to transform real-time knowledge into reusable assets that can be referenced, shared, and built upon across the organization.

Enable Consistent Training

By providing teams with standardized, recorded materials that ensure every member learns the same processes, best practices, and expectations, reducing gaps in knowledge transfer and maintaining quality across the organization.

Benefits

Build a Better Experience for Adjusters and Policyholders

Accelerate Claims Processing

Reduce Operational Costs

Boost Customer Satisfaction

SightCall VISION

Traditional claims processes are slow, expensive and leave customers frustrated.

Learn how to turn challenges into opportunities with remote visual support.

SightCall VISION

Remote Visual Support

See it. Solve it.

Auto Knowledge Capture

Xpert KnowledgeTM

Visual AI

Smarter. Faster.

Integrations

Connects with Your Existing Software Ecosystem

SightCall integrates seamlessly into your tech stack, from CRMs to InsurTech platforms.

Frequently Asked Questions

What is SightCall for Insurance and remote claims assessments?

SightCall for Insurance enables adjusters and insurers to conduct remote visual claims assessments using live video, augmented reality (AR) tools, and visual evidence capture. It allows carriers to inspect, validate, and settle claims accurately without always requiring an on-site visit.

How does remote visual support speed up the claims process?

SightCall helps insurers digitize and accelerate claim inspections by connecting adjusters and policyholders in real time. The platform allows teams to:

- Capture and verify evidence instantly through HD video and AR guidance

- Reduce travel and on-site inspection costs

- Detect and prevent fraud with geolocation and visual verification

- Automate structured claim reports immediately after each session

- Deliver faster, more transparent customer experiences

What features does SightCall provide for claims adjusters?

Claims teams benefit from a suite of visual collaboration tools, including:

- Live one-way and two-way video streaming with AR annotations and pointers

- Freeze-frame capture, photo markup, and zoom functionality

- OCR and barcode scanning for structured data capture

- Async photo and video sharing when live video isn’t possible

- Geolocation and timestamping to verify claim authenticity

- Multi-party sessions with experts, contractors, or supervisors

- Automated claim report generation integrated into existing systems

How does async photo and video sharing support remote claims workflows?

When network connectivity is limited or a live video call isn’t practical, adjusters and policyholders can capture photos or short videos asynchronously. These files automatically sync into the claim record once connectivity improves, ensuring all visual evidence is preserved and reviewed efficiently.

How does SightCall integrate with existing claims systems?

SightCall integrates seamlessly into major claims management platforms, CRMs, and workflow tools. Visual evidence, notes, and session metadata flow directly into the existing claims environment, reducing manual data entry and improving visibility across every stage of the claim lifecycle.

What platforms and devices are supported for adjusters and policyholders?

SightCall supports iOS and Android mobile apps and a browser-based console for Windows and macOS. When bandwidth is limited, users can rely on async photo and video sharing to document evidence that syncs automatically once a connection is restored.

How does SightCall handle poor connectivity in remote claim environments?

In low-bandwidth or offline conditions, adjusters can switch to async photo and video sharing to capture required visuals. When connectivity returns, all images and videos sync automatically, maintaining continuity in the claims process.

Can multiple stakeholders join a claims session?

Yes. SightCall supports multi-party collaboration, enabling supervisors, contractors, and experts to join a session for validation, consultation, or oversight—without needing separate visits or duplicate inspections.

What security and compliance standards does SightCall meet?

SightCall meets enterprise-grade security and regulatory standards including GDPR, HIPAA, SOC 2 Type II, and CCPA. Features such as end-to-end encryption, consent workflows, audit logging, masking, and configurable retention policies ensure data privacy and compliance in every claim.

How do insurers deploy SightCall in their claims operations?

Deployment typically includes assigning administrators, integrating SightCall with the claims management system, defining remote claims use cases, training adjusters and support teams, piloting initial workflows, and scaling across business lines based on results.

What performance improvements can insurers expect?

Insurers using SightCall report measurable gains such as:

- Up to 60% faster claim cycle times

- Reduced operational costs from fewer site visits

- Stronger fraud detection and data accuracy

- Higher customer satisfaction and NPS

How can I see SightCall for Insurance in action?

Request a demo to experience how SightCall enables faster, more accurate, and customer-friendly remote visual claims assessments powered by live video, AR guidance, and async photo and video sharing.

Ready for a demo?

Smarter Claims Start Here

Unlock effortless claims processing with innovative remote solutions