Insurers can move to a self-service model within the underwriting, claims and fulfilment process to improve data collection and accuracy, and both empower and delight customers.

Thanks to the likes of Amazon, Uber, and Deliveroo, today’s consumer expects 24/7 service. With a culture of instant gratification and as people’s lives get busier, consumers want their problems fixed almost instantly, on their own terms, and at a time that’s convenient for them.

As a direct result of changing customer expectations, many organizations, including insurance companies and third-party adjusters, are offering self-service options for initiating claims in order to shorten claims life cycles while increasing efficiency and customer satisfaction.

What is Digital Process Automation?

Automation is changing the way certain tasks get done and how service organizations can scale and evolve the way they do business, as well as the expectations of your customers and the options they are provided around service.

Digital Process Automation (DPA) is a way to digitize any business process by using software to automate and optimize common workflows. By creating a Digital Flow for policyholders to complete, insurance organizations can provide step-by-step guidance to collect needed information during the claims process.

Self-Service Claims

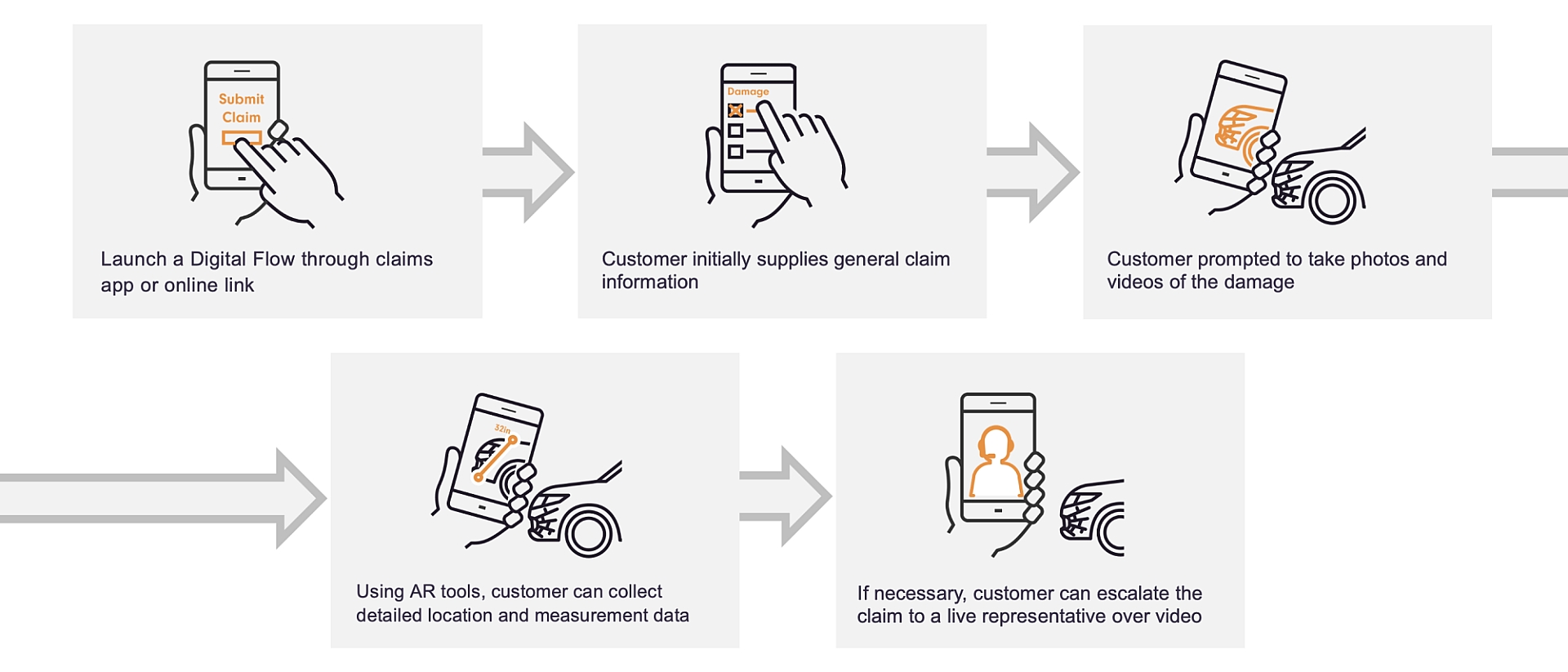

Fully customizable Digital Flows for claims can be created by insurers and shared with their policyholders via a QR code in their policy, via text or email link, or from a website chat bot.

Processes like the first notification of loss (FNOL) can be fully digitized to offer self-service options with support. Any policyholder can access and complete a Digital Flow on their mobile device by following a series of prompts and questions to collect all needed information.

When the Digital Flow is completed, everything needed to process the claim has been collected including geo-location data, HD photos and videos. All forms, signatures, location data and media are automatically uploaded into the claims file for review.

If a policyholder needs help at any point during the self-service process, they can immediately escalate to a live visual claims session where a trained adjuster can help them gather the information through a live video feed.

Digital Process Automation with SightCall Digital Flows

SightCall Digital Flows is the most advanced digital process automation solution for visual, self-guided task execution. SightCall’s platform transforms the claim experience into an enhanced customer experience that empowers the policyholder, streamlines data collection, and allows insurers to effectively and accurately allocate resources.

Digital Flows can be fully integrated and connected to other systems and partners within the insurers’ ecosystem, ensuring the policyholder is being supported correctly based on the information they are providing.

Common Insurance Use Cases for Digital Process Automation

Digital Process Automation (DPA) for FNOL

Collect all necessary information from the policyholder to start a claim. With SightCall Digital Flows, most information around the policyholder’s details including name, address, policy number, etc. is automatically pulled through into the Digital Flow for the policyholder to check and accept. They can then initiate a claim and collect the information needed.

Digital Process Automation (DPA) for Claims

The policyholder can document and share all relevant information around a claim directly from a Digital Flow. They can take photos, share videos, upload OCR readings, verify their location and more, directly through the Digital Flow. All collected information is pushed back into the insurers existing systems, such as a CRM. If they need help during the claims process, they can immediately escalate to a live video support session with an adjuster who can guide them to finish the process.

Digital Process Automation (DPA) for Claims Fulfilment

During the fulfillment phase of a claim, all relevant work can be captured, documented, and even assessed through a Digital Flow, ensuring the relevant evidence of completed work is captured for audit.

Digital Process Automation (DPA) for Underwriting Inspections

Even before a policy had been taken out by a customer, they can take advantage of a digital flow through an underwriting inspection, to correctly capture all the necessary information they need in order to receive an accurate premium cost.

A Fully Customizable Experience

Digital Flows can be created, defined, and customized to fit both the specific needs of your insurance organization as well as the look and feel of your brand. Here is an example of how an express insurance claim can occur using SightCall Digital Flows:

Customer Snapshot

This Claims Management organization now uses SightCall Digital Flows to streamline their processes and accurately capture data during the fulfillment phase of a claim. Improperly performed work can lead to costly penalties to the business, especially when image-based evidence of the work carried out during fulfillment is not properly documented and saved. Through using SightCall Digital Flows the customer has digitized their contractor overview process, with information and related videos for audit readily available and saved within their CRM.

Read the full case study here.

Benefits of SightCall Digital Flows for Insurance Organizations

Streamlined and Standardized Processes

All information from a claim can be collected through a pre-defined set of forms that can be reviewed by an expert adjuster or during a fulfillment audit. This reduces human errors and reduces the likelihood of any critical information being missed or lost during the claims or fulfillment process.

Increased Efficiency for Adjusters

Adjusters can waste up to 5 minutes on each call they have with a policyholder who is trying to find their policy details. With SightCall Digital Flows, you can almost eliminate this lost time, so that adjusters have more time to focus on a claim, speeding up the entire process, minimizing costs, and providing a faster, smarter experience for the customer

Faster Claims

With a more streamlined process, the entire claims lifecycle can be faster and more efficient, allowing the insurer to effectively allocate and use resources while ensuring that the policyholder’s experience is both modern and fast.