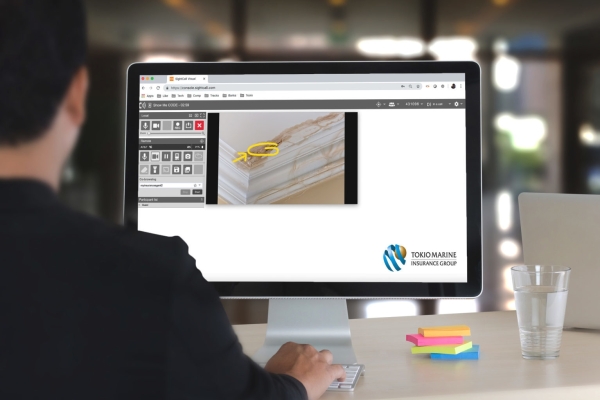

SightCall, the world’s leading AR-powered visual support platform, and Tokio Marine & Nichido Fire Insurance Co., Ltd(hereinafter “TMNF”, Japan’s largest property/casualty insurance group, are pleased to launch AR-powered video claims in Japan. With this partnership, TMNF adjusters can now handle insurance claims remotely during times of disaster, sharing high resolution audio and video between disaster sites and remote TMNF offices. Over SightCall’s secure, stable platform, adjusters can provide an immediate damage assessment and faster payments for TMNF customers.

When typhoons or heavy rains occur in Japan, insurance company assessors and/or damage appraisers generally have to carry out field surveys or document surveys to estimate what damage can be covered by the policy. The time it takes to pay out a claim is largely dependent on obtaining customer documentation, determining if a field survey is required and executing an onsite visit. However, during large scale disasters, such as earthquakes and tsunamis, a more efficient process is required to deal with the higher volume of claims. SightCall enables TMNF to immediately deploy remote adjusters who can confirm and document damage through live, AR-powered video claims.

“Due to Japan’s proximity to the Pacific Ocean’s Ring of Fire, the country has been greatly affected by some of the worst natural disasters of the 21st century. SightCall makes it possible for TMNF to connect their customers and agents at the disaster site with their experts at the office so that they can accurately confirm the damage in real-time, without making the customer wait for field visits or go through the process of resubmitting documentation,” stated Alex Leroux, MD Asia, Middle East & Africa at SightCall. “We are deeply honoured to partner with TMNF in the digital transformation of their disaster response and to provide them with a stable and secure communication platform that will help them respond quickly to their customers in times of need.”

This is a first step and both parties are looking forward to expanding the use of SightCall to other areas of the business and leveraging SightCall’s integration capabilities with TMNF’s claims system, and also AI technology, to continue to innovate and transform TMNF’s claims process.

TMNF and SightCall current Use Cases Include:

Flooding: TMNF will be able to identify the origin and the scale of damage and immediately confirm what is covered by the insurance policy.

Earthquakes: TMNF employees in affected areas will be able to use SightCall to witness operations on the ground, assess the damage faster and ensure customers are compensated faster.

Water Leakage: TMNF will use SightCall to quickly and accurately determine the scale of damage and the origin of the issue.

General Inspection: For a wide range of accidents, TMNF will use SightCall to compare the damage onsite with documents sent by customers, making it no longer necessary to request additional photos or documentation.

See the official press release from Tokio Marine here.