You can’t stop accidents before they happen.

That’s an unfortunate truth for insurance companies.

You have no way of warning Debbie about the guy on his phone who is going to run the red light. You can’t tell her to speed up or slow down. You can’t stop time.

His car is going to hit hers. It’s going to be loud and scary. And even though nobody will be seriously hurt, Debbie is going to have a really bad day.

The best you can do is not make it worse.

Once Debbie calms down and reaches for her phone, everything that happens next is up to you. This is your moment to shine.

What kind of experience will Debbie have?

Hint: It should be effortless and quick with clear communication and empathy.

Debbie doesn’t want to listen to hold music, download forms or go over contact information you should already know.

She wants speed, clarity and convenience.

And if you can’t deliver… there’s always someone else who can.

It wasn’t always like this for insurance companies, but times have changed.

Have you changed along with them?

Disruption Demands Innovation

It’s been a rough few years for the insurance industry.

One global pandemic. Multiple record-breaking storms and natural disasters. A world economy that feels like an amusement park thrill ride.

Premium growth slowed. Inflation grew. In a 2022 report, McKinsey noted that profit in the insurance industry “is practically at a standstill.”

Thanks to companies like Amazon, customers have higher expectations when it comes to standards of service. They want speed and simplicity. They aren’t afraid to exercise their power of choice.

To make matters worse for carriers, a wave of upstarts and entrepreneurs have come along in recent years with hopes of reinventing the insurance industry with new technology and bold business models based on big data.

Insurtech has disrupted the status quo the same way that Fintech shook up the banking world. And while investment in Insurtech has dipped slightly after peaking in 2021 (at $14.4 billion), the threat to stubbornly traditional companies remains real.

McKinsey’s report noted that Insurtechs can solve “customer pain points through a digitally enhanced client experience that could pose a competitive threat to incumbents.”

These challenges and competitors have made one thing clear to legacy insurers: it’s time to evolve. Digital transformation is the only option for survival.

Because while P&C companies around the world are experts at assessing risk for others with formulas and complex math, they don’t need a calculator to understand that the cost of doing nothing is way too high.

“Only a transformative approach will allow an insurer to survive and thrive in a post-COVID-19 world.” – McKinsey Global Insurance Report 2022

The Future of Insurance Technology

Insurance is complicated.

Major carriers have deep wells of expertise and experience. Industry knowledge acquired over decades, and sometimes centuries, of doing business.

It’s unrealistic to think that one product, application or piece of software can transform your company overnight.

But when it comes to useful tools that can elevate the customer experience, streamline inefficient processes, and put your company on the path to operational excellence?

Nothing helps grow your bottom line better (or faster) than the right technology.

Here are five of the biggest tech topics that we think will keep coming up in insurance industry conversations in the year ahead…

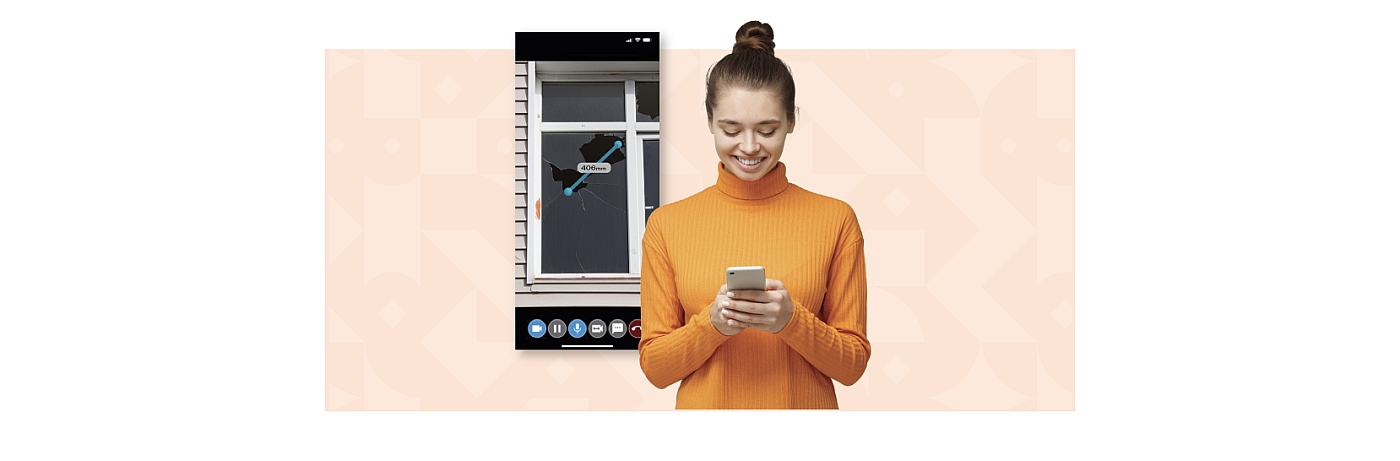

1. Visual Claims

People hate wasting time.

For decades, the only way that agents and customers connected to deal with a claim was in person. Even companies who prided themselves on excellent service made their customers wait for it.

Agents could spend hours in transit, hours on site and hours trying to hustle home before supper. Even if the claim was filed and business was sealed with a handshake and smile, it was still sandwiched between a whole bunch of waiting around doing nothing.

Wasted minutes. Wasted miles.

Today, companies can connect immediately from anywhere to anywhere. They’ve been doing it for a while and the tools keep getting better and better.

Advanced visual capabilities are giving agents the ability to go beyond live video to collect data using advanced tools like geolocation, OCR, augmented reality (AR) and artificial intelligence (AI).

While not every claim can be resolved remotely, the right visual claims tool can dramatically reduce unnecessary travel (reducing carbon emissions) and speed the resolution of a claim (the cutting of a check).

Even better? The features and functionality of these technologies are continuously evolving to meet the needs of your customers and service teams.

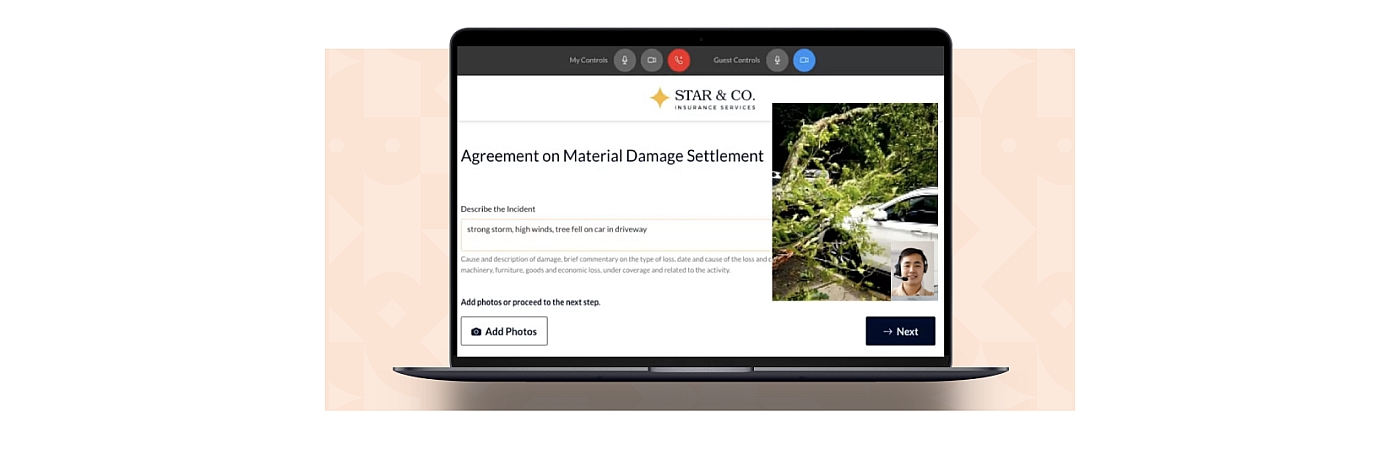

2. Digital Process Automation

Nobody gets excited about paperwork.

Plodding your way through a pile of physical forms is the epitome of drudgery.

Unfortunately, assessing risk is a complicated business that comes with lots of documents and tons of tiny print that needs to be entered, reviewed, initialed, and signed. The more of those manual processes that insurers can transition beyond pen and paper, the better.

Companies can’t realistically expect to evolve if they’re still bogging their people down with busywork. Filling out forms by hand is slow, wasteful, and prone to human error. And mistakes cost money.

Consider these stats from KPMG:

- 25% of every premium dollar is consumed by operating expenses

- Automation can reduce repetitive agent work by 80%

- Automation can also cut claims processing time by 50%

What is digital process automation? Simply put, it’s trading manual processes and forms for a digital alternative that can be completed online or on a smartphone or tablet.

Implementing digital automation can lower operational costs and speed outcomes.

This kind of automation is not about handing jobs to robots, it’s about empowering your employees and customers with better ways to do business. It’s about designing repeatable electronic instructions that reduce friction and create seamless experiences.

It’s about working smarter, faster, and more efficiently.

3. Omnichannel

Customers want control.

Providing different ways to connect is giving them that control.

Most insurers understand the basic concept of “omnichannel” and communicate with customers via telephone, snail mail, email, text and chatbots or forms that live on their website.

But the big shift comes when companies can make those customer channels smarter and easier to use. The key is to provide an engaging experience anywhere and everywhere. At any time.

It’s great to have a chatbot that can answer basic questions or connect people to a customer service agent. But it’s even better to have a chatbot that learns and gets smarter with every conversation.

One of the biggest benefits of expanding and enhancing your omni channel offerings? Customers are more likely to self-serve.

Shifting more and more of the less complex questions and tasks to self-service mode will save countless hours and resources over time.

But don’t forget: customers don’t want to get stuck alone in “the matrix.”

In a conversation with the Insurance Innovation Reporter, Peter Blanc, group chief executive at Aston Lark said, “Clients hate digital journeys with no ability to exit or talk to a human… we shouldn’t use digital to ‘force’ clients into an efficient journey that could leave them unsatisfied and unable to get a solution.”

Always give them a way to connect with a person.

“The equation is pretty simple: the easier you make it to buy and sell insurance, the more insurance you’ll sell. The harder you make it, the less you’ll sell.” – Chuck Wilson via Coverager

4. Data Integration

Remember the forms that digital process automation helps reduce?

Those stacks of paper might be gone, but all of the information inside those boxes and blanks need to go somewhere. Sometimes in the rush to roll out new technology and tools it’s easy to overlook compatibility.

Think of each app or software platform as an athlete on your team. Even if you have a team of superstars on the field, things fall apart if they’re all speaking a different language.

That’s why one of the most important building blocks of operational efficiency is data integration. The first step in building a more efficient ecosystem is to break up silos. Your systems and platforms need to talk and work together.

Sometimes that requires digital transformation on a larger scale.

One expert at Forrester estimated that “over 90% of companies are using technology to modernize their existing business model vs. transforming it.”

The bad news? Transforming will take longer and cost more.

The good news? Transforming your full tech stack will help create a more robust customer journey and generate new worlds of revenue opportunity.

A great way to get started? Invest in digital tools that play well with others.

5. Artificial Intelligence + Augmented Reality

They call them buzzwords for a reason.

You hear everybody talking about “augmented reality” and “artificial intelligence” because they work.

According to Microsoft, by 2025, artificial intelligence (AI) is predicted to drive 95% of customer experience. And Deloitte stated that 88% of medium-sized businesses are already using or testing AR for some purposes.

How can you use AI and AR in insurance?

Companies have already implemented these tools to enhance the customer experience and help agents do everything from assess damage and detect fraud to streamline claims processing and optimize routine office tasks.

Augmented reality is already available and in use by agents who connect with customers through advanced visual claims tools.

And here’s the thing about artificial intelligence: it gets smarter every day. The quicker you put it to work inside your company, the faster it can capture data and insights that you can use to differentiate yourself in the market.

“…the mission should not be: how do we take what we do today and deliver in a digital way? Instead, we should focus on how we seamlessly blend the capabilities that digital provides into the perfect customer service.” – Phillip Williams, Clear Group via Insurance Age UK

Are you ready for the future of insurance?

Nobody knows for sure what happens next, but everybody is getting buckled up for a bumpy ride.

Insurers know better than anyone that you should always expect the unexpected. Hope for the best, but plan for the worst. You know the drill.

In terms of digital transformation, maybe it’s best to think of each piece of technology as a tool. A tool to give your customer a better experience and help your agents and brokers focus on what matters.

A tool to drive efficiency and improve flexibility.

A tool that prepares you for the future.

Yes, it can all be a bit overwhelming. But remember that innovation doesn’t have to be an all or nothing deal. There isn’t a company on the planet that can reinvent everything all at once. It doesn’t happen with a snap of the fingers.

If you’re feeling behind the technology curve, the most important step you can take is the first one. Do something. Test one tool. Make one process more efficient.

If you’re moving forward, you’re headed in the right direction.